we turn projects

into emotions

In Ecoedile, trasformiamo un progetto in un’emozione offrendo un’experience unica e sostenibile.

La cosa più importante per realizzare un’idea è l’armonia. Per questo abbiamo imparato nel tempo che si devono rispettare alcune regole e solo dopo averle comprese è possibile concretizzare un progetto. Ci hanno insegnato a non esagerare e ad amare le cose belle e lineari. La bellezza della storia e dell'arte non cambia mai ed è questo che ci spinge a fare sempre meglio continuando ad amare le cose belle.

Enzo e Daniele Nembrini

TRASFORMIAMO PROGETTI IN ARCHITETTURA, COSTRUIAMO LUOGHI DI SCAMBIO E DI VITA

Project

Portfolio

LE NOSTRE MIGLIORI REALIZZAZIONI IN AMBITO RESIDENZIALE, INDUSTRIALE, COMMERCIALE E ALBERGHIERO.

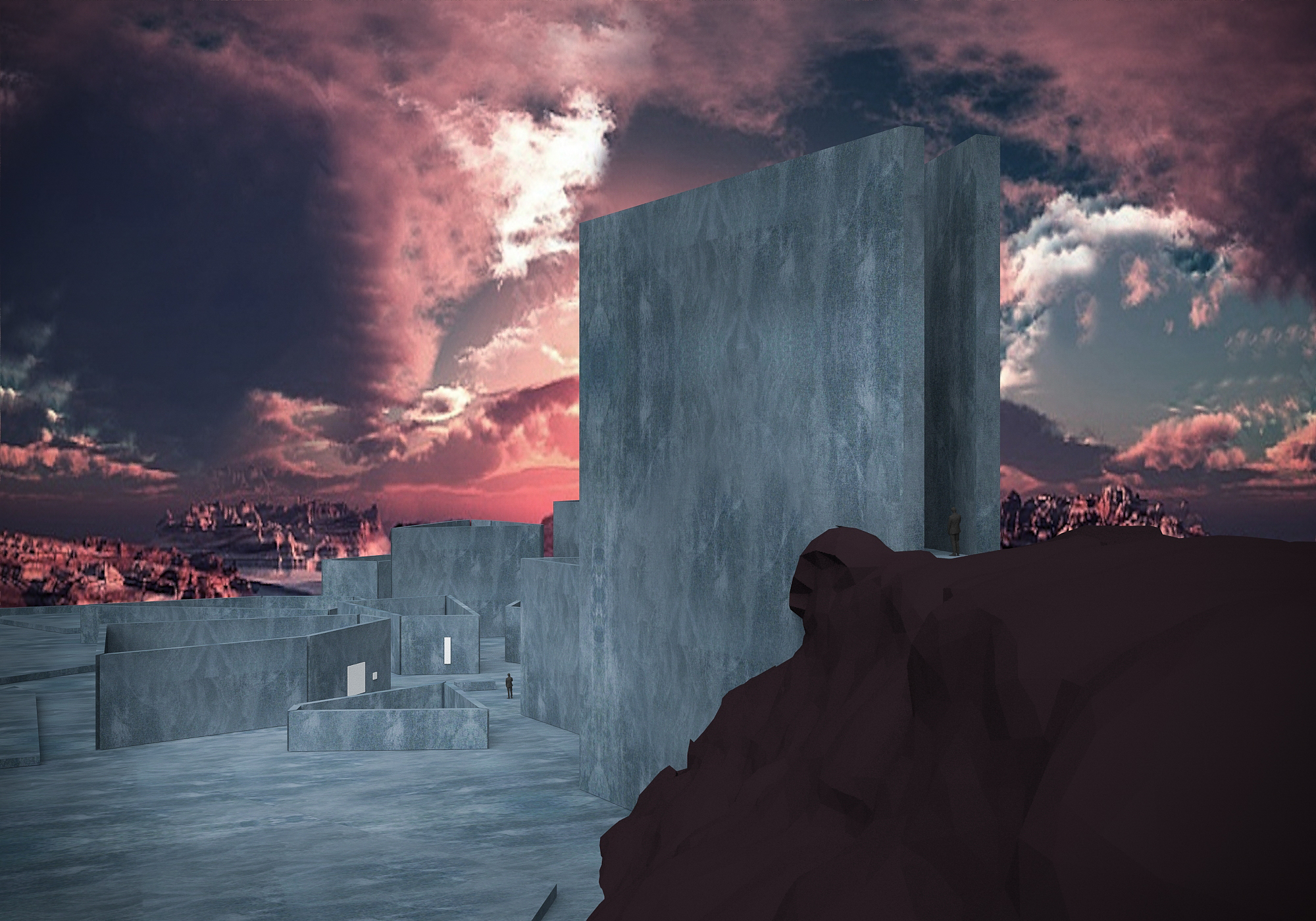

Tutti i progettiUn virtual museum

costruito nel metaverso

Sede della collezione nembrini e project room per spazi interattivi